Use the chart below to see how your bill could change with the Base Services Charge. Why? The lower cost per kilowatt-hour may not decrease your cost enough to cover the Base Services Charge, …

The social security wage base limit is $184,500. The Medicare tax rate is 1.45% each for the employee and employer, unchanged from 2025. There is no wage base limit for Medicare tax. Social security …

Please let us know if you have any questions or need any additional information. Compiled by: Lisa R. Volland, CPA, Partner, Tax Department

Dec 10, 2025 · The following information is provided to assist you in complying with the contribution withholding requirements and payment provisions of the Temporary Disability Insurance (TDI), …

Covers Defense Civilian Intelligence Personnel System in Occupational Series 0132/Work Role Science and Technology Analysis (Requires scientific or engineering degree); 0401/Supporting select S&TI...

The Defense Authorization Amendments and Base Closure and Realignment Act, Public Law 100-526, established the Defense Base Closure Account (BRAC I) as a mechanism to provide the required …

- [PDF]

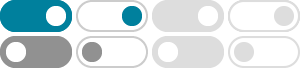

Minimum Base Bill

Base charge: A fixed monthly amount to cover the cost of the meter, billing and providing customer service. It is applicable whether or not electricity is used in a given month.